Understanding Cryptocurrency Security: How Safe Are Your Digital Assets?

Understanding Cryptocurrency Security: How Safe Are Your Digital Assets?

Cryptocurrency has revolutionized the way we think about money and financial transactions. With its decentralized nature, blockchain technology, and potential for high returns, cryptocurrencies have gained immense popularity. However, with great potential comes significant risks. Understanding the security of cryptocurrency is crucial for anyone looking to invest, trade, or store digital assets.

What Is Cryptocurrency?

Cryptocurrency is a digital or virtual form of money that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. Bitcoin, Ethereum, and Ripple are some of the most well-known examples.

While the technology offers transparency and security at a systemic level, individual users still face risks related to hacking, fraud, and negligence.

Key Features of Cryptocurrency Security

1. Blockchain Technology

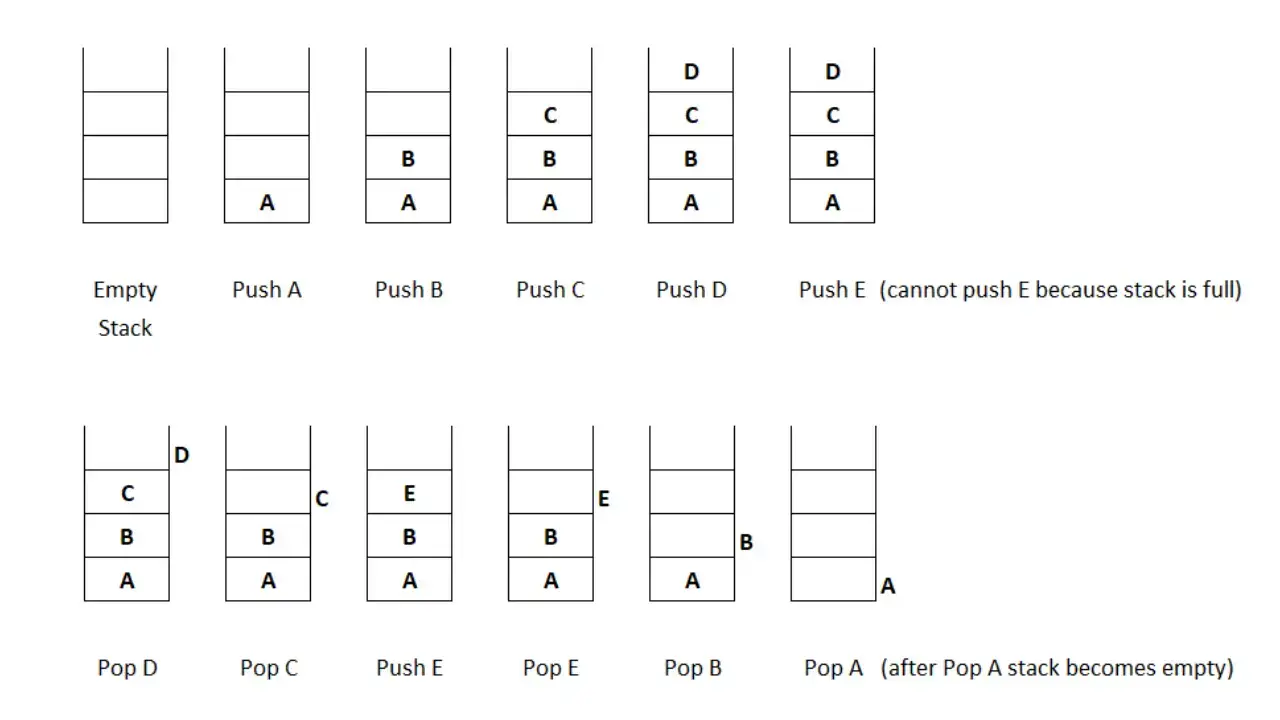

The backbone of cryptocurrency is blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers. This decentralized structure makes it highly secure and resistant to tampering.

2. Encryption and Cryptography

Cryptocurrencies use advanced cryptographic techniques to secure transactions and wallet addresses. Private keys, which are unique to each user, are essential for accessing and managing digital assets.

3. Immutability

Once a transaction is recorded on the blockchain, it cannot be altered or deleted. This immutability ensures that transaction records are reliable and tamper-proof.

Common Cryptocurrency Security Risks

Despite the inherent security features of blockchain technology, cryptocurrencies are not immune to threats. Here are some common risks:

1. Hacking

Cyberattacks on cryptocurrency exchanges, wallets, and individual users are a major concern. Hackers often exploit vulnerabilities in systems to steal funds.

2. Phishing Attacks

Phishing involves tricking users into revealing sensitive information, such as private keys or passwords. Fraudulent websites and emails are common tools used in these attacks.

3. Malware

Malware can infect devices and compromise cryptocurrency wallets. Keyloggers, ransomware, and clipboard hijackers are examples of malware targeting crypto users.

4. Human Error

Misplacing private keys, falling for scams, or sending funds to the wrong address can result in irreversible losses. Unlike traditional banking, there are no intermediaries to rectify mistakes in the crypto space.

5. Regulatory Risks

Lack of regulation or changing legal frameworks in different countries can also impact the safety and legitimacy of cryptocurrencies.

How to Enhance Cryptocurrency Security

To mitigate these risks, here are some best practices for safeguarding your digital assets:

1. Use Secure Wallets

- Hardware Wallets: These are physical devices that store private keys offline, making them immune to online hacking.

- Software Wallets: Use reputable wallet providers with strong encryption and multi-factor authentication (MFA).

2. Enable Two-Factor Authentication (2FA)

Always enable 2FA for cryptocurrency exchanges and wallets to add an extra layer of security.

3. Avoid Public Wi-Fi

Using public Wi-Fi for crypto transactions increases the risk of interception. Always use a secure, private connection or a Virtual Private Network (VPN).

4. Backup Your Wallet

Regularly back up your wallet’s private keys and store them in multiple secure locations, such as encrypted USB drives or safe deposit boxes.

5. Stay Informed

Keep yourself updated on the latest security threats and trends in the cryptocurrency world. Awareness is a powerful tool against scams and hacking attempts.

6. Verify URLs and Emails

Always double-check URLs and email addresses before entering sensitive information. Phishing scams often use fake websites that mimic legitimate ones.

The Role of Exchanges in Cryptocurrency Security

Cryptocurrency exchanges play a crucial role in the ecosystem. However, not all exchanges are equally secure. When choosing an exchange, consider the following:

- Reputation: Research the exchange’s history, user reviews, and security record.

- Security Features: Look for features like cold storage, insurance for funds, and anti-phishing measures.

- Regulatory Compliance: Ensure the exchange complies with regulations in your jurisdiction.

Future Trends in Cryptocurrency Security

As technology evolves, so do the methods used by cybercriminals. However, advancements in security technologies are also on the rise:

1. Multi-Signature Wallets

These wallets require multiple private keys for a transaction, making unauthorized access significantly harder.

2. Quantum-Resistant Cryptography

With the advent of quantum computing, traditional cryptographic methods may become vulnerable. Quantum-resistant algorithms are being developed to address this issue.

3. AI-Powered Security

Artificial intelligence can identify and mitigate threats in real time, enhancing the security of exchanges and wallets.

FAQ's

How safe are cryptocurrency?

Crypto assets are volatile and high-risk investments

Crypto assets are risky investments because their value may rise and fall suddenly and significantly. These changes in value are hard to predict.

What is security in cryptocurrency?

Crypto security, therefore, involves protecting these digital assets through various measures and practices, ensuring the safety of the user's funds and personal information from potential cyber threats. The importance of cryptocurrency security is directly linked to the unique characteristics of the technology itself.

Is cryptocurrency a safe way to invest?

Cryptocurrency investing carries substantial risks and should be approached with caution. This market is prone to high volatility, uncertainty, dishonest practices, theft, and more. However, crypto assets also present unique potential for those willing to accept the elevated risks.

What is a crypto asset?

Crypto assets—also known as digital assets—are assets that are issued or transferred using distributed ledger or blockchain technology. They include, but are not limited to, so-called virtual currencies, coins, and tokens.

Is crypto haram?

In Islam, financial practices that involve speculative behavior or excessive risk are generally discouraged. Cryptocurrencies' drastic fluctuations might fall into this category, and thus, they can be considered Haram by some Muslims.

0 Comments

No Comment Available